We are dedicated to providing our customers with the quickest quotes, best quality products, most competitive prices, and fastest possible deliveries of open die forgings and seamless rolled rings to ASTM, AMS, AISI, ASME, and other industry standard specifications and customer requirements, proven by our documented results on chemistry, physical properties, heat treatments, forging integrity and overall customer satisfaction.

Contact us today. In The U.S. 1 (973) 276-5000 / 1 (800) 600-9290. In Canada 1 (416) 363-2244. Email us at sales@steelforge.com. One of our forging specialists is standing by to help you save time and money on your next forging job.

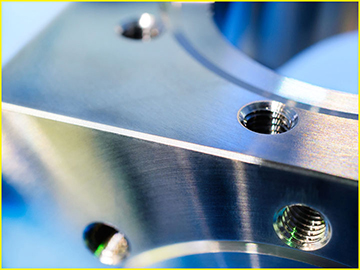

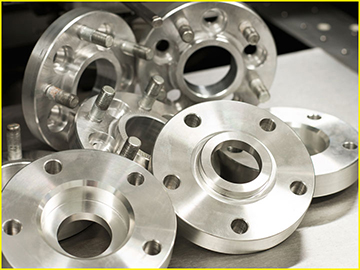

SEAMLESS ROLLED RINGS UP TO 200”

Specializing in large and heavy weight forgings

We manufacture high-quality seamless rolled rings with excellent tensile and yeild properties for gear, bearing and heavy machinery applications. We can produce rings up to 200” in steel alloys and up to 80” in other alloys.

40 YEARS OF QUALITY AND RELIABILITY

Industry leaders in quality forged products

We are dedicated to providing its customers with the quickest quotes, best quality products, most competitive prices and fastest possible deliveries of open die forgings and seamless rolled rings to ASTM, AMS, AISI, ASME and other industry standard specifications and customer requirements, proven by our documented results on chemistry, physical properties, heat treatments, forging integrity and overall customer satisfaction.

All Metals & Forge Group Videos

Watch our latest commercials

Does your forge shop tell you they can’t make your part because it’s too big, too heavy, they don’t have the material or they can’t machine it? When other shops say “No”, All Metals & Forge Group says “Yes!” Contact us today for a fast quote on your next forging project.

SEND YOUR RFQ

Quotes in 48 hours or less.